My Benefits 2025

Your Medical Benefits

Eligibility

Employees who work a minimum of 20 hours per week are eligible to participate as of their date of hire.

Benefit Details

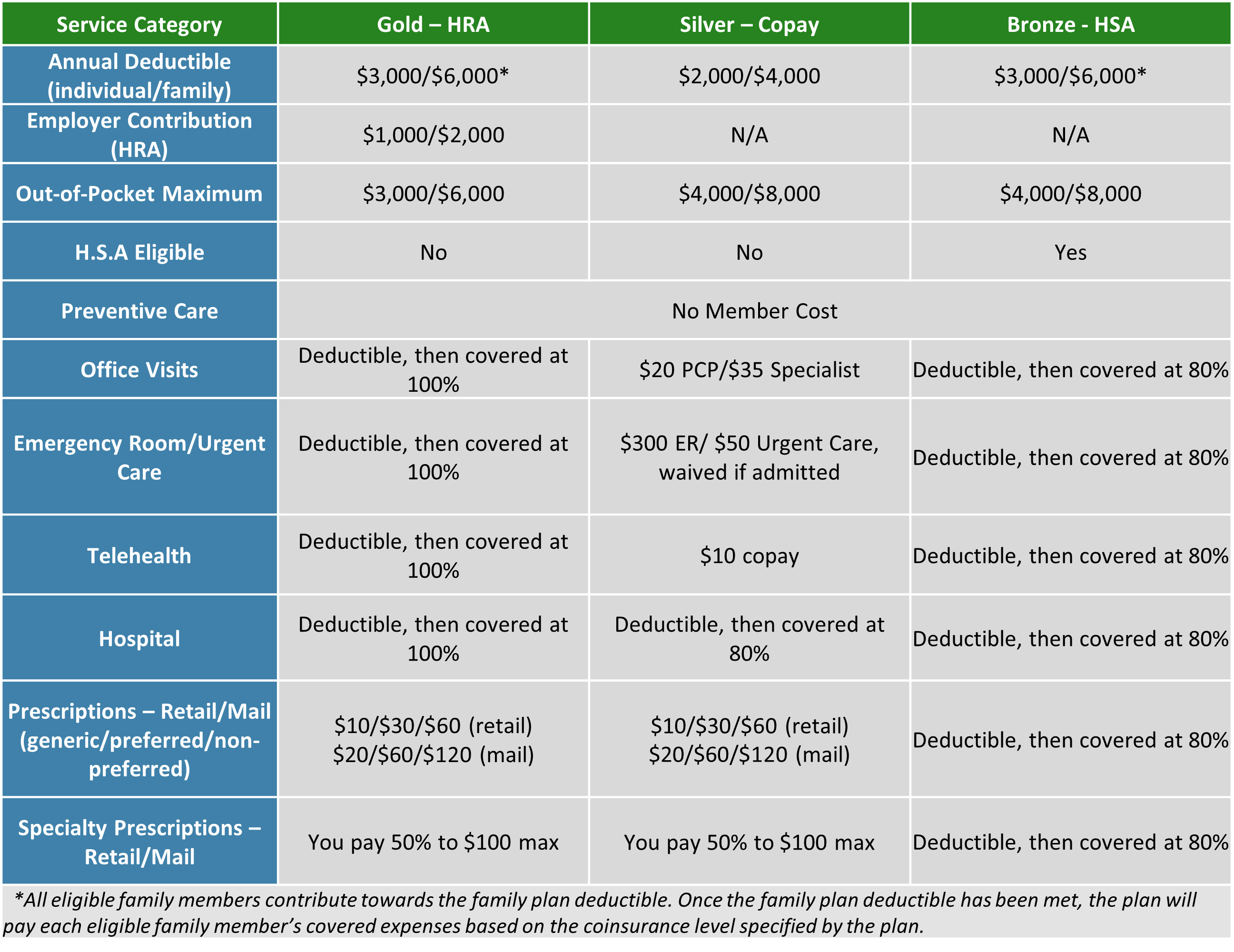

World Learning offers three medical plans through Cigna. Below you will find a plan comparison chart that can help assist you in choosing the plan that best suits your needs.

A surcharge of $100 per pay period will be incurred for spouses and domestic partners who remain on World Learning’s plan if they have access to coverage through their own employer.

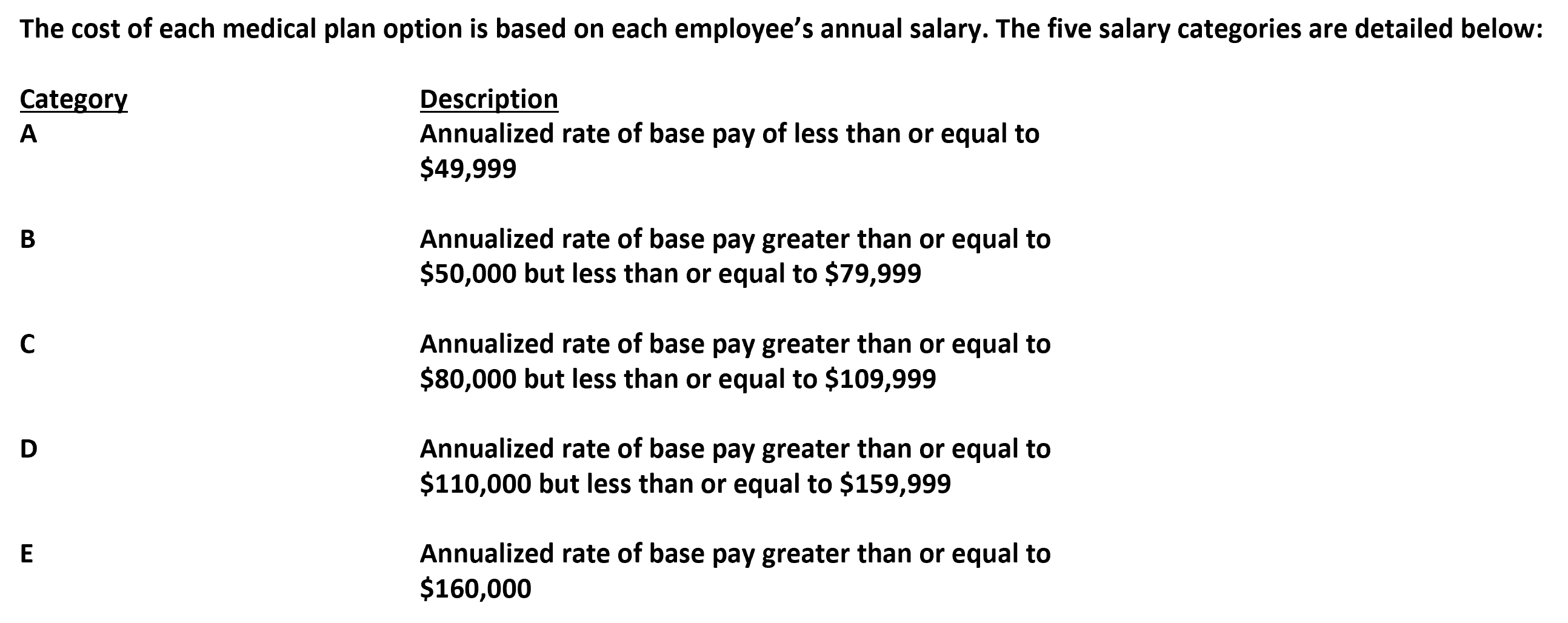

Employee contributions for the medical plan are determined based on each employee’s annual salary. To view all plan rates, please refer to the employee contribution page at the end of this booklet.

Bi-Weekly Contributions

Additional Programs

World Learning offers the following value-added programs through your Cigna medical plan.

Omada Diabetes Prevention Program

New in 2025, Cigna’s Diabetes Prevention Program in collaboration with Omada is a program to help you avoid the onset of diabetes, as well as health risks that might lead to heart disease or a stroke.

Program participants have access to a professional virtual health coach, an online support group, interactive lessons, and a smart-technology scale. You may also be offered the opportunity to join a gym for a discounted monthly fee.

There is no cost to members who participate in this program, and it is highly recommended to members at risk for type 2 diabetes. To see if you are eligible, you can complete a confidential 1-minute health screening questionnaire.

Cigna 90 Now Pharmacy Benefits

The Cigna 90 Now program helps you manage your prescription medication needs by enabling you to fill 90-day supplies of maintenance medications. You will get to choose between the CVS Pharmacy network or the Walgreens Pharmacy network. Both networks have over 55,000 pharmacies in them; they are not limited to just CVS or Walgreens.

If you choose the network with CVS in it, your medication won’t be covered at Walgreens or any of its affiliate pharmacies. If you choose the network with Walgreens in it, your medication won’t be covered at CVS or any of its affiliate pharmacies. However, each covered dependent on your plan has the option to choose their own individual pharmacy network. For example, you can choose the CVS network, and your spouse or child can choose the Walgreens network.

You can change your pharmacy network by calling 800-244-6224 or by visiting www.mycigna.com, clicking on “Profile” in the upper righthand corner, and following the on-screen instructions.

Pathwell Bone & Joint Program

If you have chronic lower back pain or osteoarthritis, Cigna’s Pathwell Bone & Joint Program can help. You’ll be partnered with a care advocate who can connect you with the care you need, within Cigna’s robust network of chiropractors, physical therapists, mental health professionals, and orthopedic surgeons.

This program offers $0 or low-cost musculoskeletal surgery if you use a qualified provider within the Pathwell network. For more information, call 877-505-5875 or visit cignabackpainhelp.com.

SaveOnSP – Manufacturers’ Coupons for Specialty Medications

Cigna has partnered with SaveOnSP to maximize available manufactures’ coupons for your specialty mediations. If you are filing an eligible medication, a representative from SaveOnSP will call you to walk you through enrolling in the program.

Coupon funds that apply to the cost of the medication will not accumulate towards your plan deductible.

Patient Assurance Program – Insulin Cost Savings

Cigna’s Patient Assurance Program ensures that your eligible insulin products are capped at $25 for a 30-day supply. You will receive a letter from Cigna if a medication you take is eligible.

Contact Information

Cigna: Medical Insurance

Customer Service: 800-244-6224

Website: https://my.cigna.com/web/public/guest

Click here for the Cigna Provider Directory

Benefit Summaries

Summaries of Benefits and Coverage

Certificates

Formulary

You can access Cigna’s most current Prescription Drug List by clicking on the link below, selecting “Drug Lists for Employer Plans,” then selecting “4 Tier (all specialty medications covered on tier 4) [PDF]” from the drop-down.

Transparency in Coverage

By clicking on the button below, you will be led to the machine readable files that are made available in response to the federal Transparency in Coverage Rule and includes negotiated service rates and out-of-network allowed amounts between health plans and healthcare providers. The machine-readable files are formatted to allow researchers, regulators, and application developers to more easily access and analyze data.

Additional Plan Information

Your Telehealth Benefits

Telehealth Services

Employees can access telehealth services to treat minor medical conditions like colds, flus, sore throats, allergies and more. Cigna’s telehealth services allow employees to connect with a board-certified doctor via video or phone.

Appointments can typically be scheduled within one hour or less. It is recommended that you complete the telehealth registration process before services are needed to make scheduling an appointment quicker in the future.

Telehealth is included with all three medical plans. Telehealth visits through MD Live are free once you meet your deductible if enrolled in the Gold HRA Plan, a $10 co-pay for the Silver Copay Plan, and covered at 80% after deductible for the Bronze HSA plan.

For more information or to register for telehealth services, call 888-726-3171 or go to Virtual Care (Telehealth) Services | Cigna Healthcare

Contact Information

![]()

MD live for Cigna: Telehealth Benefit

Customer Service: 888-726-3171

Website: https://www.mdliveforcigna.com/

Your Mental Health Resources

Cigna Mental Health Resources

As part of our commitment to helping you prioritize your well-being, your Cigna medical plan also offers a robust network of virtual and in-person mental health resources. Whether you’re seeking support for anxiety, depression, or other mental health challenges, these resources are designed to provide confidential, professional help when you need it most.

Here’s how to get started:

- Log in to your account at https://my.cigna.com/web/public/guest

- Under the “Wellness” tab, click on “Mental Health Support”

- From there, you can search the virtual and local provider network by specialty

Virtual Counseling

MDLive

- Visit mycigna.com or www.mdliveforcigna.com | Ages 10+

- MDLIVE allows users to talk to a therapist or psychiatrist via video only (for behavioral services). These providers can provide therapy, diagnose, treat and prescribe medications for many common mental health conditions during non-emergency situations. Users do not gain direct access to a provider; they need to schedule a day/time for their appointment.

Talkspace

- Visit mycigna.com or talkspace.com/covered | Ages 13+

- The Talkspace app provides virtual access to licensed therapists via live video and private texting, plus psychiatrist services and additional resources.

- Copay/coinsurance and deductible apply. Services are submitted and coded as a claim, per occurrence. Text-based therapy is billed per 60 minutes, on average once per week.

Headspace (Formerly Ginger)

- Visit mycigna.com or https://organizations.headspace.com/connect | Ages 18+

- Headspace virtually connects members with a certified coach via texting and app-based programs to help them manage anxiety, depression and daily stressors 24/7/365. If needed, a coach can add a licensed therapist or psychiatrist to the care team within days.

- Copay/coinsurance and deductible apply. Member cost-share for coaching services; unlimited coaching is billed monthly, while other services are billed per occurrence.

Brightline

- Visit mycigna.com or www.brightline.com/benefits | Ages 18 months-17 years.

- Brightline is a national pediatric behavioral health provider that provides extraordinary support for kids, teens, and parents. Even better, it’s all delivered virtually, so you can get support when and where you need it. When you sign up for Brightline, you will immediately have access to care for kids 18 months–17 years old – and support for you, too.

- Copay/coinsurance and deductible apply. Member cost share for coaching services, unlimited coaching billed monthly, other services billed per occurrence.

Happify

- happify.com/cigna | Ages 18+

- The Happify app features science-based activities and games designed to help lessen symptoms of depression and change behavior.

- No cost

iPrevail

- iprevail.com/cigna | Ages 13+ (with parental consent)

- iPrevail offers 24/7 access to digital peer coaching and peer support using cognitive behavioral therapy techniques, interactive video lessons and support communities.

- No cost

Cigna Employee Assistance Program (EAP)

In addition to your mental health benefits, Cigna’s EAP provides you with:

- Up to 3 free sessions per issue, per year (excludes psychiatric services and medication management)

- Discounted legal and financial consultation services

- Referrals and resources for needs such as adoption, child/elder care, and home repairs

To learn more:

- Log in to your account at https://my.cigna.com/web/public/guest

- Under the “Coverage” tab, click on “Employee Assistance Program (EAP)”

Cigna Behavioral Health Seminar Series

Cigna offers interactive video seminars presented by guest experts on the following topics:

- Autism

- Eating Disorders

- Mental Health

- Substance Use Disorders

To sign up for upcoming seminars and view past ones, visit:

Contact Information

![]()

MD live for Cigna: Telehealth Benefit

Customer Service: 888-726-3171

Website: Virtual Care (Telehealth) Services | Cigna Healthcare or www.mdliveforcigna.com

Talkspace: Telehealth Benefit

Customer Service: 888-846-4821

Website: mycigna.com or talkspace.com/covered

Headspace (Formerly Ginger): Telehealth Benefit

Customer Service: 855-432-3822

Website: mycigna.com or https://organizations.headspace.com/connect

Email: caresupport@headspace.com

Brightline: Telehealth Benefit

Customer Service: 888-224-7332

Website: mycigna.com or www.brightline.com/benefits

Email: care@hellobrightline.com

Your Health Reimbursement Account Benefits

Eligibility

Only employees enrolled in the Gold Health plan are eligible for a Health Reimbursement Account (HRA).

Health Reimbursement Account Information

A Health Reimbursement Account is a funding arrangement provided by your employer to help offset expenses for members enrolled in the Gold Plan. HRA funding is $1,000 (single) and $2,000 (two person or family). These funds will be applied toward eligible out of pocket expenses.

The HRA is 100% employer paid.

Contact Information

Cigna: Medical Insurance

Customer Service: 800-244-6224

Website: https://my.cigna.com/web/public/guest

Your Health Savings Account Benefits

Eligibility

Only employees enrolled in the Bronze Health plan are eligible for a Health Savings Account (HSA).

Health Savings Account Information

What is a Health Savings Account?

A Health Savings Account or HSA is a tax-advantaged savings account owned by an individual that can be used to pay for qualified medical expenses for the owner and their dependents. An HSA, which must be paired with an HSA-qualified health plan (the Bronze Plan), allows employees to make pre-tax contributions into a federally insured account.

- World Learning offers an employee funded Health Savings Account (HSA) in conjunction with the Bronze Plan. The HSA is administered by Cigna in conjunction with HSABank.

- Employees can make pre-tax contributions to an HSA if they are enrolled in the Bronze Plan.

- In 2025, the maximum HSA contribution limits are $4,300 (single) or $8,550 (two person/family). There is a $1,000 catch-up contribution for age 55+.

- HSA funds can be used to pay for qualified medical expenses and/or certain dental & vision expenses that are not covered by the medical plan.

- Funds in an HSA rollover from one year to the next and can be taken with you when employment ends.

- Visit www.mycigna.com to learn more about your medical plan, track claims & account balances, and manage your healthcare finances.

Contact Information

Cigna: Medical Insurance

Customer Service: 800-244-6224

Website: https://my.cigna.com/web/public/guest

Additional Information

Your Flexible Spending Account & Dependent Care Account Benefits

World Learning offers three different types of flexible spending accounts to employees (Health Care FSA, Limited Purpose FSA, and DCA). Employees may contribute pre-tax dollars into these accounts to help offset eligible medical expenses or dependent care expenses. The plans are administered by Cigna.

Health Care Flexible Spending Account (FSA)

- Funds from a health care FSA can be used for qualified expenses including medical, dental, vision, deductible, co-payments and coinsurance. With an FSA, the entire elected amount is available on the first day of the health plan year. The maximum amount you may contribute to the health care FSA is $3,300. In 2025, the FSA includes a rollover provision that allows employees to rollover $660 of unused funds into the next plan year. Employees who elect the Bronze Plan with a Health Savings Account may only contribute to a Limited Purpose FSA which can only be used for dental and/or vision expenses.

Dependent Care Reimbursement Account (DCA)

A dependent care FSA allows employees to set aside pre-tax dollars to pay for qualified dependent care expenses. Funds can be used to pay for day care, preschool, or elderly care. In 2025, the maximum amount you may contribute to the dependent care FSA is $5,000 (if single or married & filing jointly) or $2,500 (if married & filing separately).

For a list of eligible FSA/DCA expenses please visit: http://www.cigna.com

Contact Information

Cigna: Medical Insurance

Customer Service: 800-244-6224

Website: https://my.cigna.com/web/public/guest

Summaries

Your FSA/HSA Store

World Learning has entered into a partnership with Health-E Commerce, also known as the FSA/HSA Store. This gives you access to hundreds of products that have been pre-vetted & approved for use with your Flexible Spending or Health Savings Accounts.

Did you know you could use your FSA/HSA to save money on everyday health essentials like baby health items, health trackers, pain relief products and more?

Here are just a few benefits of using the FSA/HSA Store:

- No Receipts Needed

- 2,500+ FSA Eligible Products

- 100% Eligibility Guaranteed

- Skip the claims process when you use your FSA/HSA card

This partnership also allows access to their Caring Mill products. Caring Mill is a line of premium healthcare products that support a healthy lifestyle and on average is priced 30% less than branded equivalent products.

With every Caring Mill purchase, a donation is made to Children’s Health Fund, providing necessary treatments to thousands of children in need, throughout the United States.

Curious what your FSA/HSA dollars can cover? Simply enter the product you are looking for in the eligibility list below.

To access the FSA Store please visit: https://fsastore.com

To access the HSA Store please visit: https://hsastore.com

Additional Information

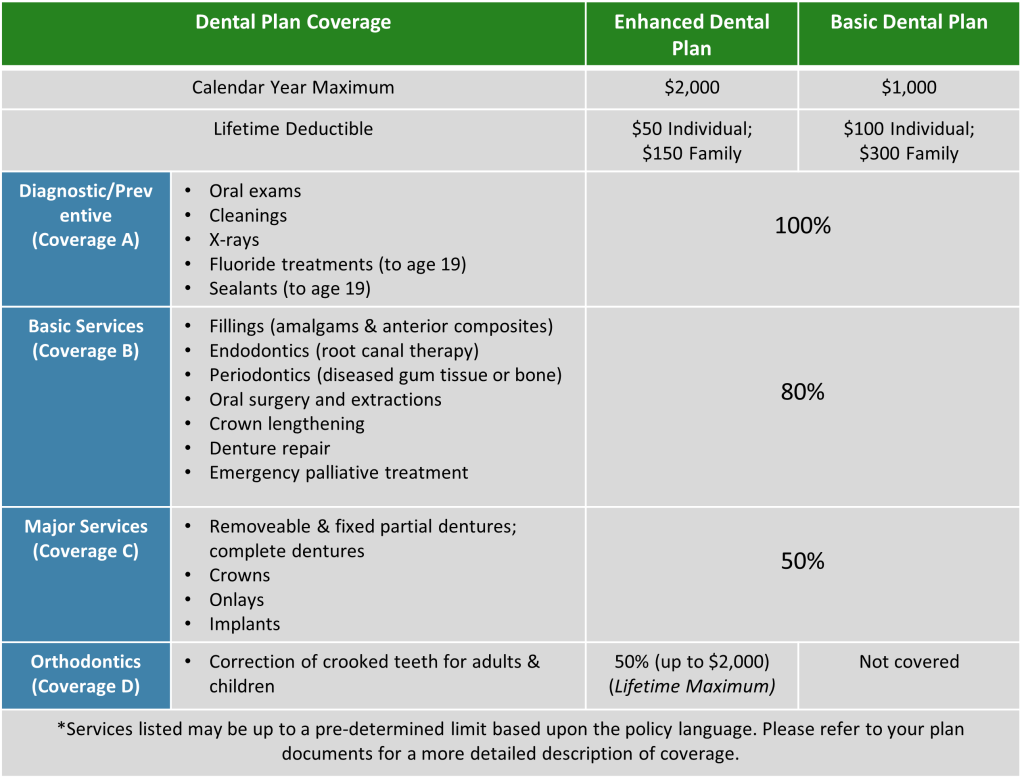

Your Dental Benefits

Eligibility

Employees who work a minimum of 20 hours per week are eligible to participate as of their date of hire.

Benefit Details

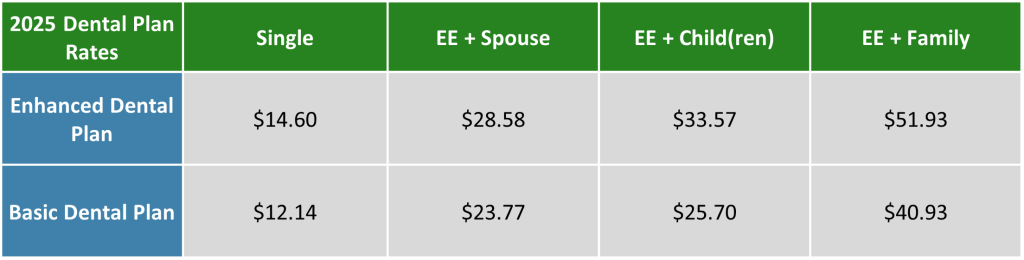

Bi-Weekly Contributions

Additional Plan Information

Health Through Oral Wellness (HOW)

A healthy mouth is part of a healthy life, and Northeast Delta Dental’s innovative HOW works with your dental benefits to help you achieve and maintain better oral wellness. HOW is all about you because it’s based on your specific oral health risk and needs. Best of all, it’s secure and confidential. Here’s how to get started:

1. Register

Go to www.healththroughoralwellness.com and click on “Register Now”.

2. Know Your Score

After you register, please take the free oral health risk assessment by clicking on “Free Assessment” in the Know Your Score section of the website.

3. Share Your Score With Your Dentist

The next step is to share your results with your dentist at your next dental visit. Your dentist can discuss your results with you and perform a clinical version of the risk assessment.

Contact Information

(800) 832-5700

Plan Documents

Additional Information

Helpful Videos from Delta Dental

Your Vision Benefits

Eligibility

Employees who work a minimum of 20 hours per week are eligible to participate as of their date of hire.

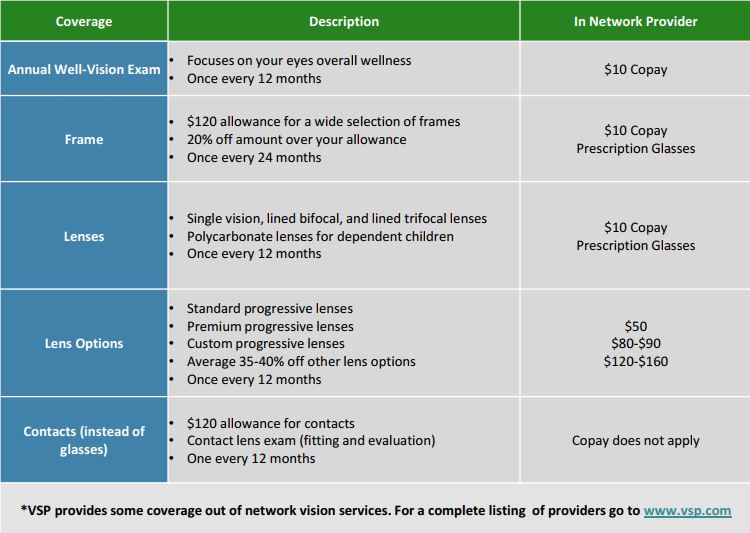

Benefit Details

Bi-Weekly Contributions

VSP Additional Programs

Do you know what is covered under your vision plan?

- Treatment for eye pain, or conditions like pink eye are covered.

- Tests to diagnose sudden vision changes

- Pictures of your eyes to detect and track eye conditions

- Exams to monitor cataracts

- Retinal Screenings

VSP Laser Vision Care

Find out if laser surgery is right for you. Your VSP coverage can save you an average of 15% off the regular price.

- Visit www.vsp.com to get details about the program, learn what to expect during surgery, and to locate a VSP Laser VisionCare doctor.

- Confirm your eligibility before scheduling an appointment by calling 800-877-7195

- Call you VSP Laser VisionCare doctor to verify that they participate in the program

- Schedule a complimentary screening.

TruHearing

TruHearing® is making hearing aids affordable by providing exclusive savings to all VSP® Vision Care members. You can save up to $2,400 on a pair of hearing aids with TruHearing pricing. What’s more, your dependents and even extended family members are eligible, too.

Here’s how it works:

- Call TruHearing at 877-372-4040. You must mention VSP

- Schedule exam with a local provider through TruHearing

- Attend Appointment

Best of all, if you already have a hearing aid benefit from your health plan or employer, you can combine it with this program to maximize the benefit and reduce your out-of-pocket expense.

Learn more about this VSP Exclusive Member Extra at https://www.truhearing.com/vsp/?mid=121

Eyeconic

Your vision and wellness come first with VSP. Your benefit includes Eyeconic, an eyewear store for VSP members.

More Bang for Your Buck at www.eyeconic.com

If you shop online for glasses and contacts, you’ll get more value on Eyeconic like

- Lowest match price guarantee

- Average savings of $220

- Up to $120 savings on an annual contact lens supply

- 20% of additional pairs of glasses or sunglasses

- HSA & FSA accepted

Plan Documents

Additional Plan Information

Your Group & Optional Life Benefits

Eligibility

Employees who work a minimum of 20 hours per week are eligible to participate as of their date of hire.

Benefit Details

Group Employee Life Insurance and Accidental Death & Dismemberment (AD&D)

World Learning provides Group Life and AD&D insurance through Unum. The benefit is provided at no cost to eligible employees.

- This benefit is 100% Employer Paid

- Coverage is 2x your annual earnings to a maximum of $500,000

- AD&D Benefit is equal to the Life Benefit

- The benefit amount is payable to family or beneficiary

- Benefit reduces to 65% at age 70, and 50% at age 75

- Accelerated Benefit – receive up to 75% of benefit to maximum of $500K if diagnosed with terminal illness

- Conversion – you can convert your group Life policy to an individual policy if you leave your job for any reason.

Supplemental Term Life (Employee, Spouse & Child) & AD&D.

- 100% Employee Paid.

- Can elect employee coverage in $10,000 increments to maximum $500K (or 5x annual salary cap).

- Can elect spouse coverage – $5,000 increments to max $500K; Child coverage – $2,500 increments to max $10K.

- Guarantee issue amounts are $200,000 for employee supplemental life coverage; $30,000 for spouse supplemental life coverage.

- Any amount elected over guarantee issue is subject to Evidence of Insurability (EOI).

Your Long & Short Term Disability Benefits

Eligibility

Employees who work a minimum of 20 hours per week are eligible to participate as of their date of hire.

Benefit Details

Short Term Disability

World Learning provides Short Term Disability insurance through Unum. The benefit is provided at no cost to eligible employees.

- 100% Employer Paid.

- Benefit is 60% of weekly earnings to maximum of $1,000 per week.

- Waiting period: 10 days for injury/10 days for sickness.

- Coverage is available for up to 26 weeks if employee is benefits eligible.

- If paid leave is exhausted prior to the 10 workday eligibility waiting period, employees may borrow up to 10 days of sick leave.

Long Term Disability

World Learning provides Long Term Disability insurance through Unum. The benefit is provided at no cost to eligible employees.

- 100% Employer Paid.

- Provides partial income replacement when you are unable to work due to sickness or injury.

- Benefit is 60% of monthly earnings to maximum of $12,000.

- 180-day elimination period.

- Benefit level will be based on salary in effect prior to date of disability.

Your Voluntary Benefits

Eligibility

Employees who work a minimum of 20 hours per week are eligible to participate as of their date of hire.

Benefit Details

Accident

World Learning provides voluntary Accident insurance through Unum. The benefit is paid by the employee.

- 100% Employee Paid

- Pays a set amount for accidental injuries on and off the job

- Payments are made directly to employee

- Can be used to cover health insurance deductible, emergency room co-pays, or other unexpected costs of an unforeseen injury

- Can file claims for multiple covered incidents

- No Evidence of Insurability (EOI) needed

- Includes $50 Be Well benefit when employee completes a covered health screening, annual exam, or immunization

What it Covers (including but not limited to):

- Broken bones

- Burns

- Knee ligament

- Dislocations

- Emergency dental

- Physical therapy

Critical Illness

World Learning provides voluntary Critical Illness insurance through Unum. The benefit is paid by the employee.

- 100% Employee Paid

- Pays a lump sum when diagnosed with a covered condition

- Payments are made directly to employee, to use however you choose

- Helps pay for out-of-pocket costs – like co-pays and deductibles – that health insurance does not cover when you face a serious illness

- Benefit payable for each condition

- Includes Be Well benefit ($50, $75, or $100, tied to coverage amount)

What it Covers (including but not limited to):

- Coronary artery disease (major 50%, minor 10%)

- End-stage renal failure

- Heart attack

- Major organ failure requiring transplant

- Stroke

- Invasive cancer (including breast cancer)

- Noninvasive cancer (25%)

Hospital Indemnity

World Learning provides voluntary Hospital Indemnity insurance through Unum. The benefit is paid by the employee.

- 100% Employee Paid

- Pays a set amount when you are admitted to the hospital due to accident, sickness, or childbirth

- Payments are made directly to employee, to use however you choose

- 24/7 coverage with no geographical limits on covered injuries and treatments

- Family coverage option available

- No Evidence of Insurability (EOI) needed

- Includes $50 Be Well benefit

What it Covers:

- Hospital admission – $1,500 once per insured calendar year

- Daily hospital confinement – $100 per day for up to 365 days per calendar year

- ICU admission – $1,500 per insured, paid once per calendar year

- ICU daily stay – $100 per day to a maximum of 30 days per calendar year

Your Employee Assistance Program (EAP)

Eligibility:

All employees and their immediate family members are eligible to participate.

- An EAP is offered to all World Learning employees & immediate family members through ComPsych Guidance Resources EAP.

- This is a completely confidential counseling program that covers issues such as marital & family concerns, depression, substance abuse, grief & loss, child & elder care referrals, legal consultations, and financial assistance.

- Employees and their family members can receive up to 5 free counseling sessions per occurrence per year.

- For more information, go to www.guidanceresources.com and click Register. You will be required to enter your Organization Web ID “World Learning” before proceeding with the registration process.

Contact Information

Your Pet Insurance Benefits

Eligibility:

Employees who work a minimum of 20 hours per week are eligible to participate as of their date of hire.

Benefit eligible employees have the option of enrolling in Pet Insurance through Nationwide Pet. Employees may purchase coverage on dogs, cats, and birds. All policies are individually written, and monthly rates are determined by breed, age, species, type of plan selected and state of residence.

Employees who wish to enroll can access the Nationwide Pet enrollment website link at https://partnersolutions.nationwide.com/pet/worldlearning. Premiums can be paid through payroll deductions (26 pay periods per year).

Contact Information

800-540-2016 (Customer Service)

877-738-7874 (Enrollment)

https://partnersolutions.nationwide.com/pet/worldlearning (Enrollment)

https://my.petinsurance.com/login (Sign In)

Plan Information

Your Parking & Transit Benefits

Eligibility

Please contact Human Resources for more information.

Benefit Details

World Learning offers commuter benefits to eligible employees. This is a pre-tax benefit account that is used to pay for public transit and qualified parking as part of your daily commute to work.

As of the date of this publication, the maximum contribution amount is $300 per month for parking and/or transit.

Employees who wish to sign up for the Parking & Transit benefit must reach out to Human Resources at hr@worldlearning.org, then register & place their order via the Wage Works participant website: https://www.wageworks.com/

Your Travel Insurance Benefits

World Learning partners with Cigna Global Envoy for your travel insurance benefit. This is a voluntary benefit and the cost is 100% paid by the employee.

Eligibility: Full-time employees, part-time employees and designated consultants under age 72, as determined by employer.

Type of Coverage: Business Travel & Sojourn Coverage

For more information, contact Human Resources at hr@worldlearning.org

Contact Information

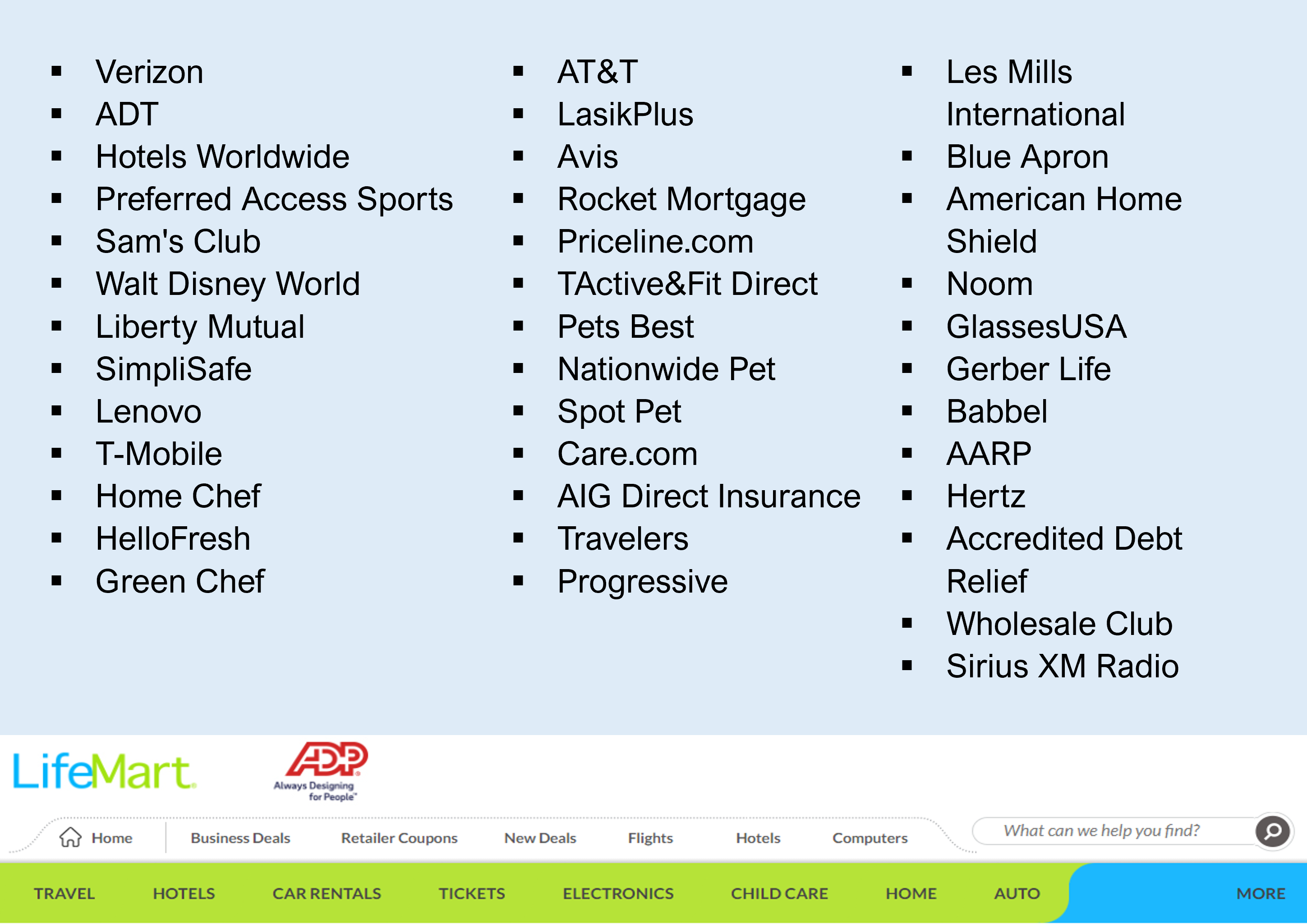

Your Employee Discounts

World Learning offers employee discounts through LifeMart.

Go to https://lm.lifemart.com/group/lifemart/home for deals and discounts or access the link through the ADP homepage.

Below is a list of participating vendors.

Contact Information

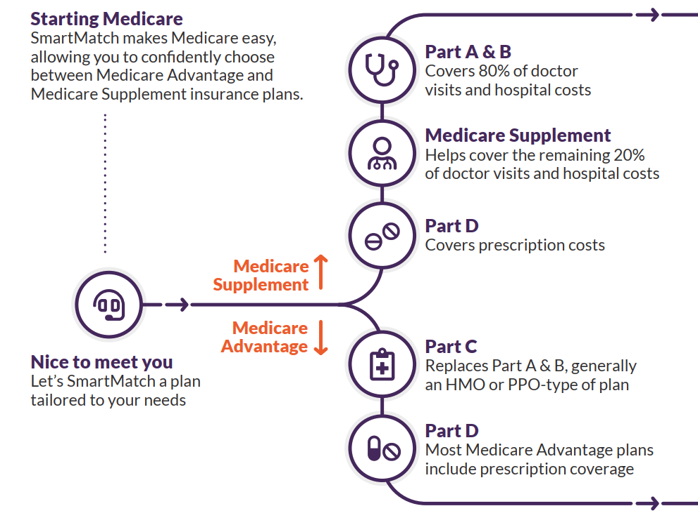

Medicare Resource: SmartConnect

World Learning and The Richards Group have partnered with SmartConnect™, an exclusive, no-cost program created specifically to connect Medicare-eligible working adults to the world of Medicare benefits. Whether you plan to continue working or are transitioning to retirement, we tailor solutions designed around your needs. Our agents provide an unfiltered view of the entire range of options and prices available to you.

SmartConnect Contact Information

833-502-2747

Additional Information

Recording of a SmartConnect Medicare Webinar

Enrollment Changes & Eligibility

Changing Elections

Benefit elections you make when you become newly eligible for benefits or at open enrollment remain in effect through December 31 of the plan year, unless you experience a qualifying life event.

You may make changes to your medical, dental, vision, health care reimbursement account and dependent care reimbursement acount elections if you experience a qualifying event such as:

- Marital status change

- Dependent status change

- Employment status change affecting eligibility or cost

- Address change that changes eligibility for benefits

- Eligibility change related to Medicare, Medicaid or state Child Health Insurance Plan (CHIP)

Any changes you make must be “due to and consistent with” your qualifying event, and the consistency requirements vary depending on the type of qualifying event. Human Resources will determine whether a requested change is due to and consistent with a qualified change in status. Contact HR for more information regarding qualfiying events and what changes can be made for each event.

To make changes, please see HR as soon as possible as you only have 30 days of the qualifying event (or 60 days if the event is an eligibility change related to Medicaid or CHIP as described in “Special Enrollment Rights” below.

Special Enrollment Rights

Certain qualifying events come with legal rights known as Special Enrollment Rights and those rights are described below.

If you are declining enrollment for yourself or your dependents (including your spouse) because of other health insurance coverage (or if the employer stops contributing towards your or your dependents’ other coverage), you may in the future be able to enroll yourself or your dependents in the medical plan, provided that you request enrollment within 30 days after your other coverage ends. In addition, if you have a new dependent as a result of marriage, birth, adoption, or placement for adoption, you may be able to enroll yourself and your dependents, provided that you request enrollment within 30 days after the marriage, birth, adoption, or placement for adoption.

If you and/ or your dependents are covered under Medicaid or a state Child Health insurance Program (CHIP) and lose eligibility for such coverage, you may be able to enroll yourself or your dependents in the medical plan, provided that you request enrollment within 60 days after the loss of coverage. Likewise, if you and/ or your dependents become eligible for Medicaid or CHIP premium assistance, you may be able to enroll yourself or your dependents in a health insurance program, provided that you request enrollment within 60 days after the date you are determined to be eligible for premium assistance.

Changes to HSA Elections

You do not need a qualifying event to change your HSA contribution amount. You may make changes to your HSA at any time during the plan year. HSA changes will typically take effect in the pay period following receipt of your request in HR.